Iron Condor

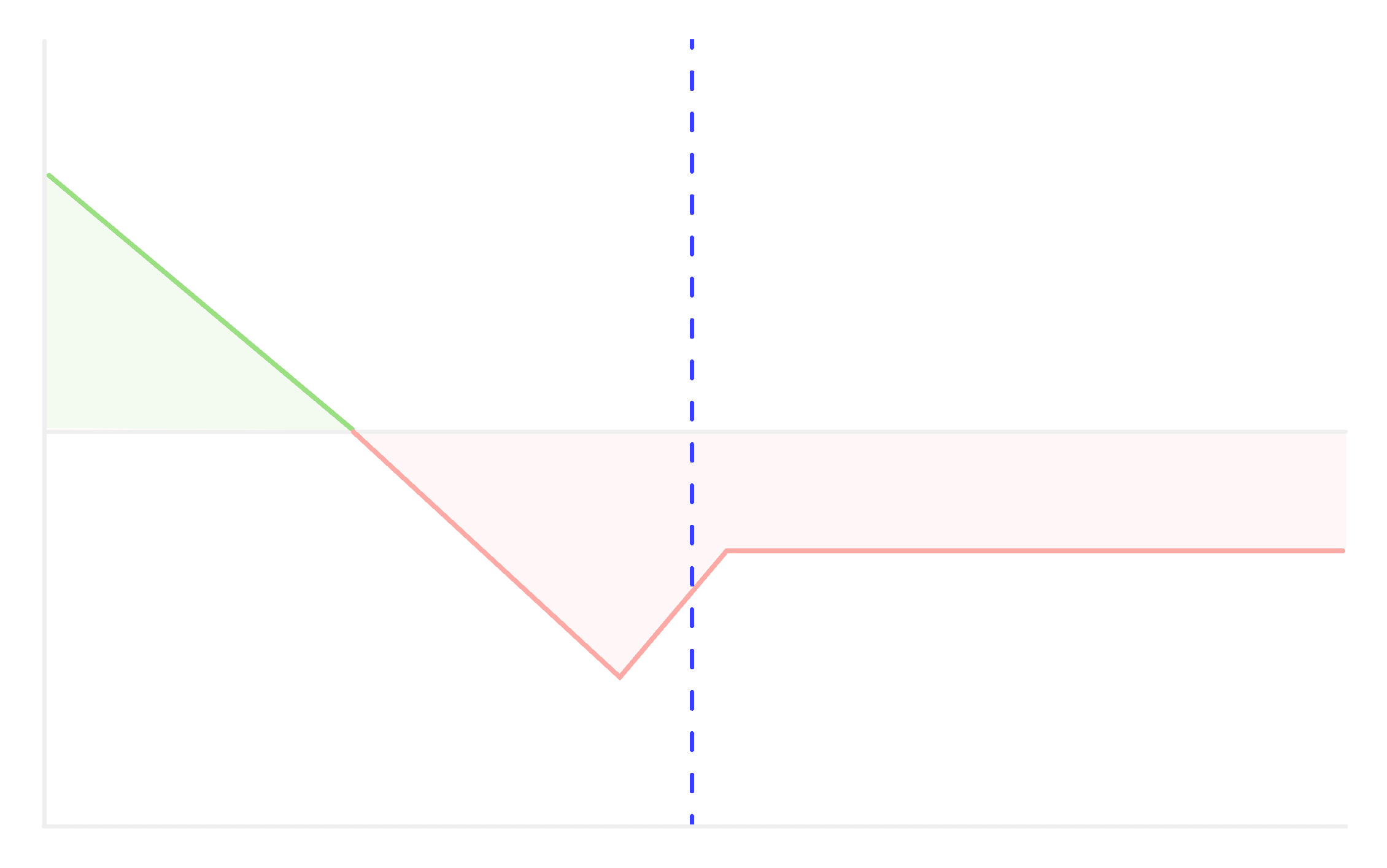

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

An iron condor is an options trading strategy designed to profit from low volatility in the underlying asset, such as the Nifty in this case. It involves combining two credit spreads: a bullish put credit spread and a bearish call credit spread. This strategy aims to generate income by selling out-of-the-money (OTM) put and call options while defining the maximum potential loss.

Here's how to construct an iron condor on the Nifty with the Nifty index at 20,000:

Assumptions:

- Current Nifty Index Level: ₹20,000

- Expiration Date: One month from today

Constructing the Iron Condor:

- Determine Strike Prices:

- You will choose four strike prices, typically equidistant from the current Nifty index level. Let's use

- the following strikes:

- Sell an OTM Nifty put option with a strike price of ₹19,600 (bearish put credit spread).

- Buy an even lower strike Nifty put option with a strike price of ₹19,250 (to limit potential losses on the put side).

- Sell an OTM Nifty call option with a strike price of ₹20,400 (bearish call credit spread).

- Buy an even higher strike Nifty call option with a strike price of ₹20,750 (to limit potential losses on the call side).

- Same Expiration Date:

- Ensure that all four options (two short and two long) have the same expiration date, typically one month from the trade date.

- Premium Calculation:

- Calculate the net premium you receive for the iron condor by subtracting the total premiums paid for the long options from the total premiums received for the short options.

- Net premium earned = - 3.45 (19250 Put Buy) + 6.7 (19600 Put Sell) - 2.3 (20750 Call Buy) + 2.9 (20400 Call Sell) = ₹3.85

- Risk and Reward:

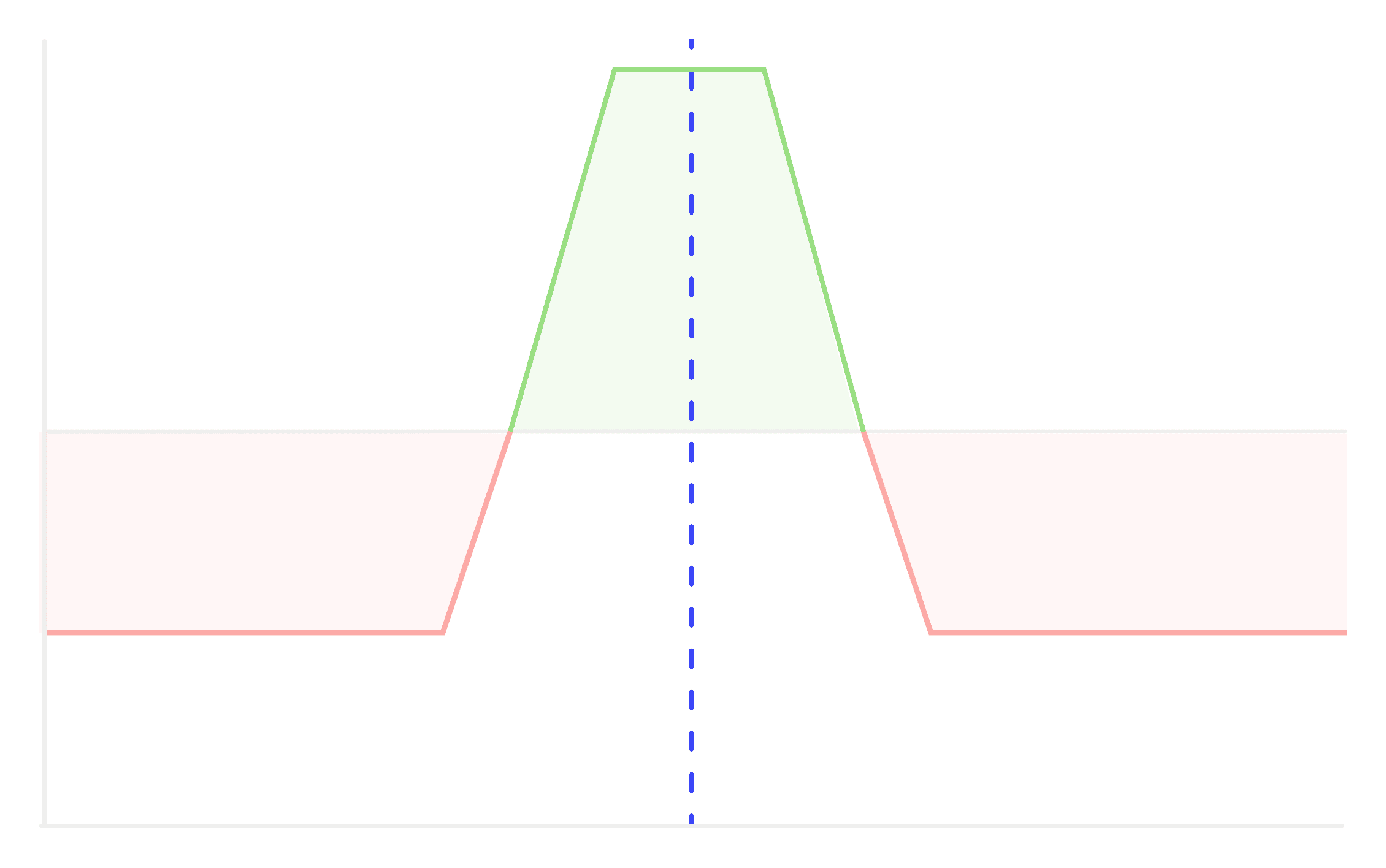

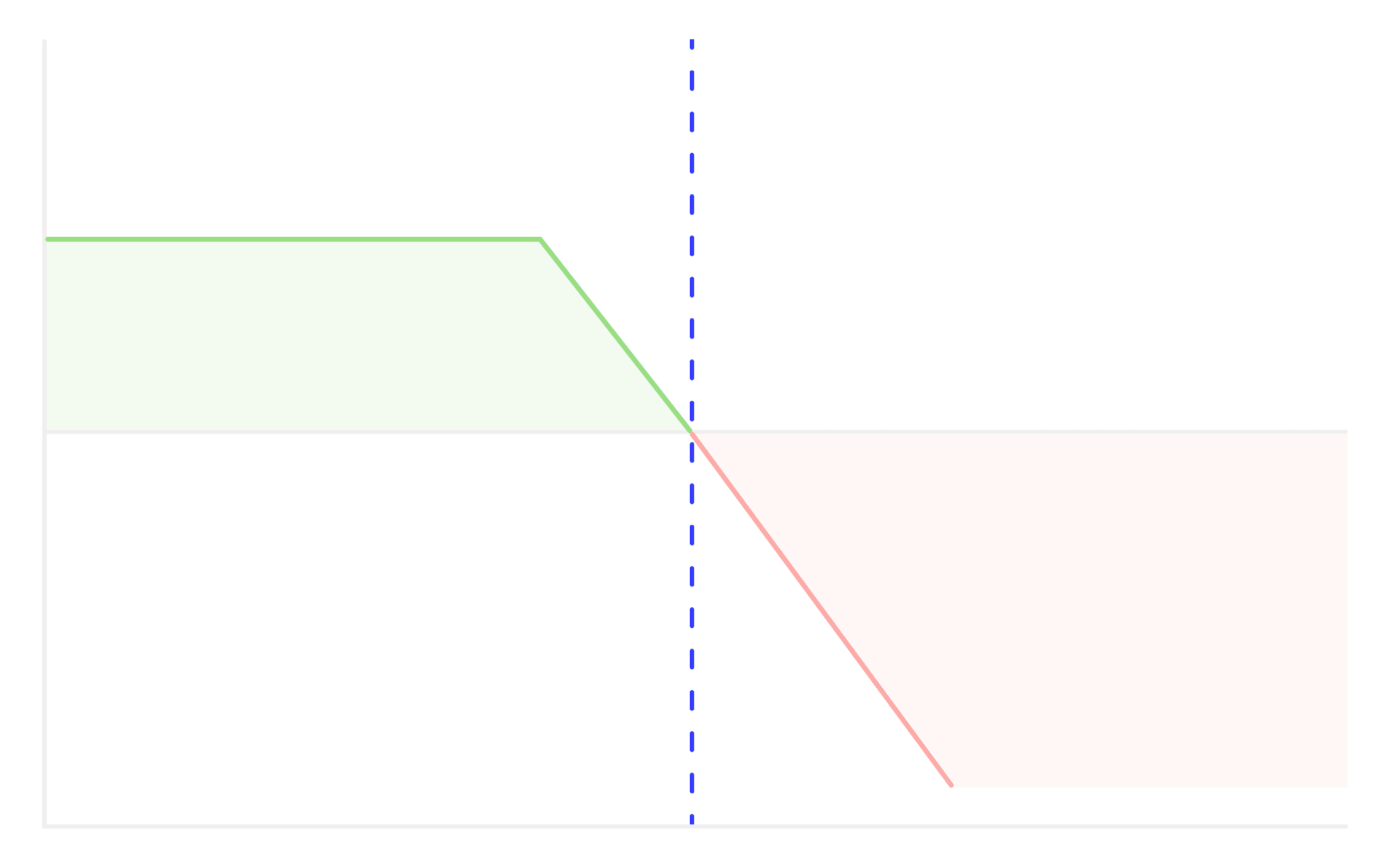

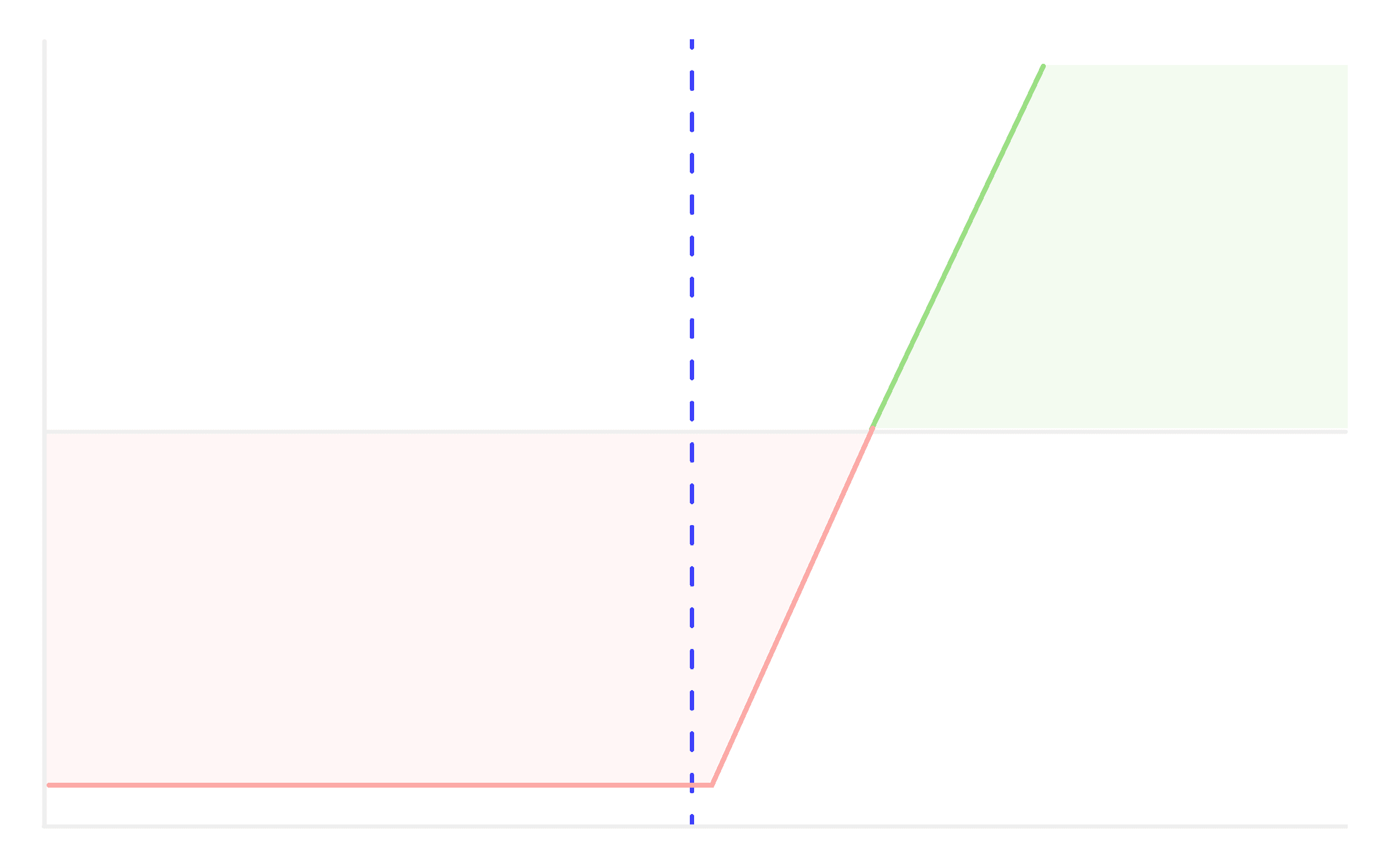

- The maximum profit is limited to the net premium received. It occurs if the Nifty index closes between the two short strikes (19,600 and 20,400) at expiration.

- The maximum loss is capped and occurs if the Nifty index moves significantly beyond the long strike on either side. The loss is limited to the width of the spreads minus the net premium received.

- Breakeven Points:

- The upper breakeven point is the short call strike (20,400) plus the net premium received. = ₹20403.85

- The lower breakeven point is the short put strike (19,600) minus the net premium received. = ₹19596.15

Keep in mind that options prices and market conditions can change, so it's crucial to analyze specific options available and their premiums at the time of your trade. Additionally, always practice proper risk management and consider consulting with a financial advisor or options expert before implementing complex options strategies.

Other Strategies

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

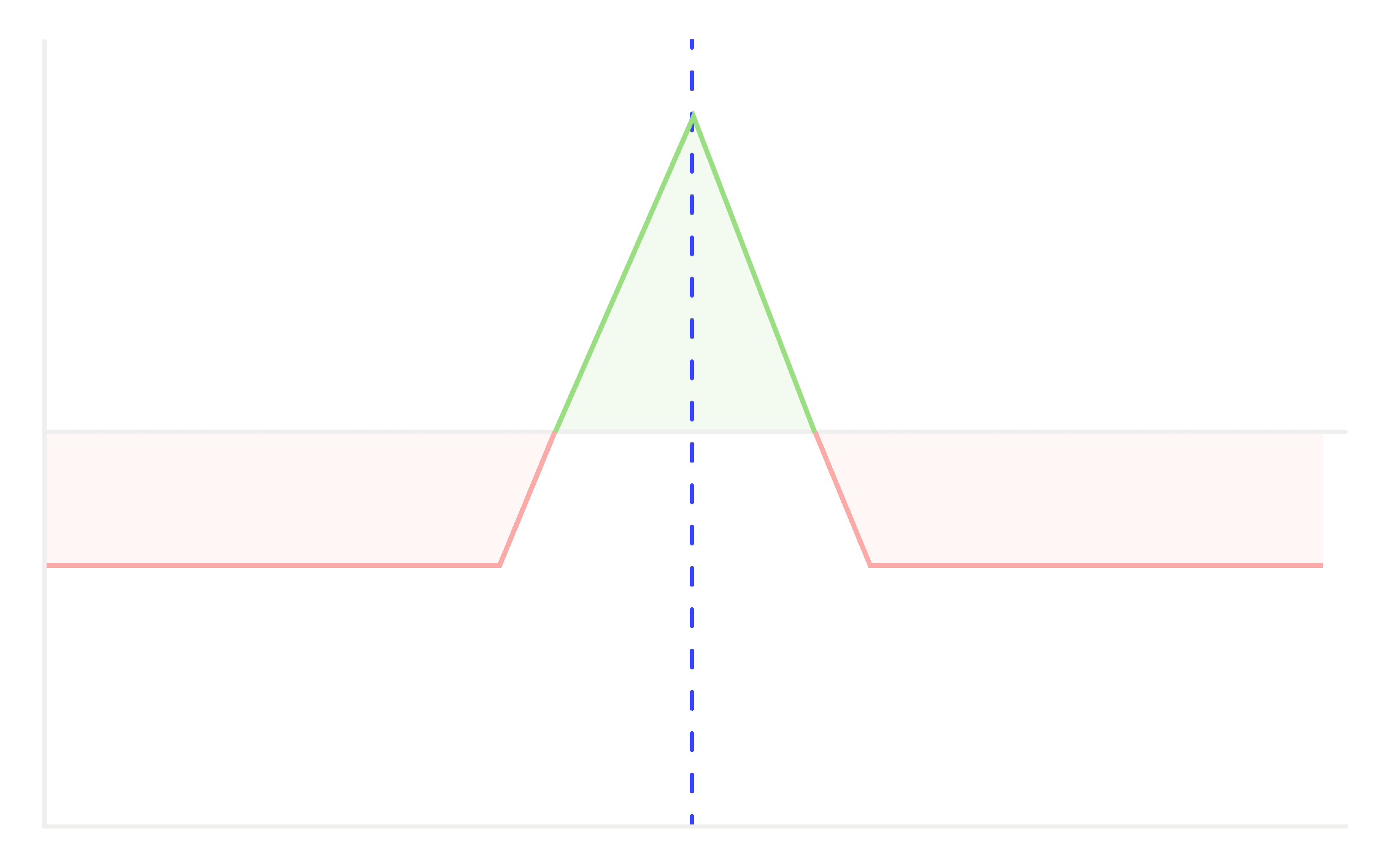

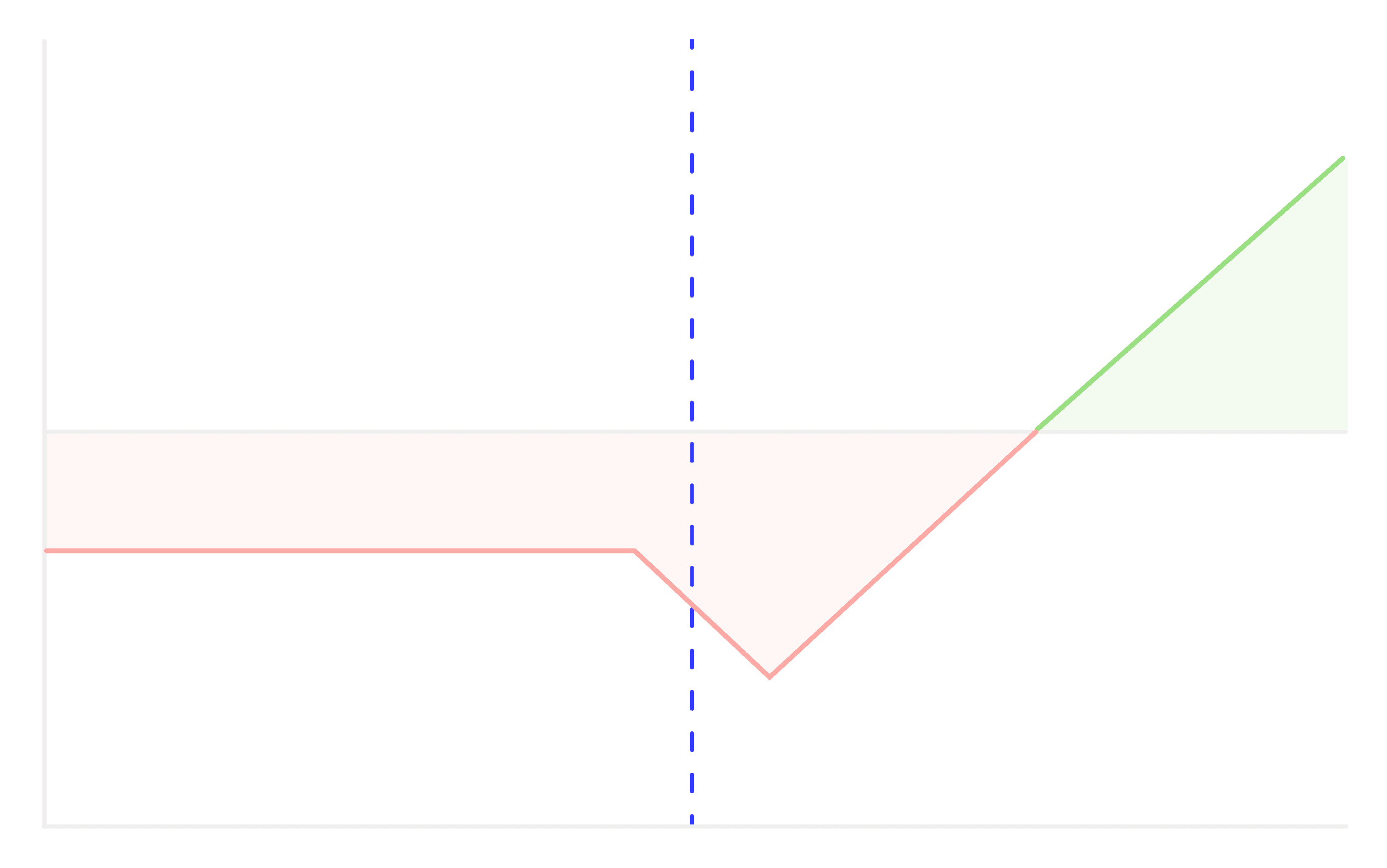

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

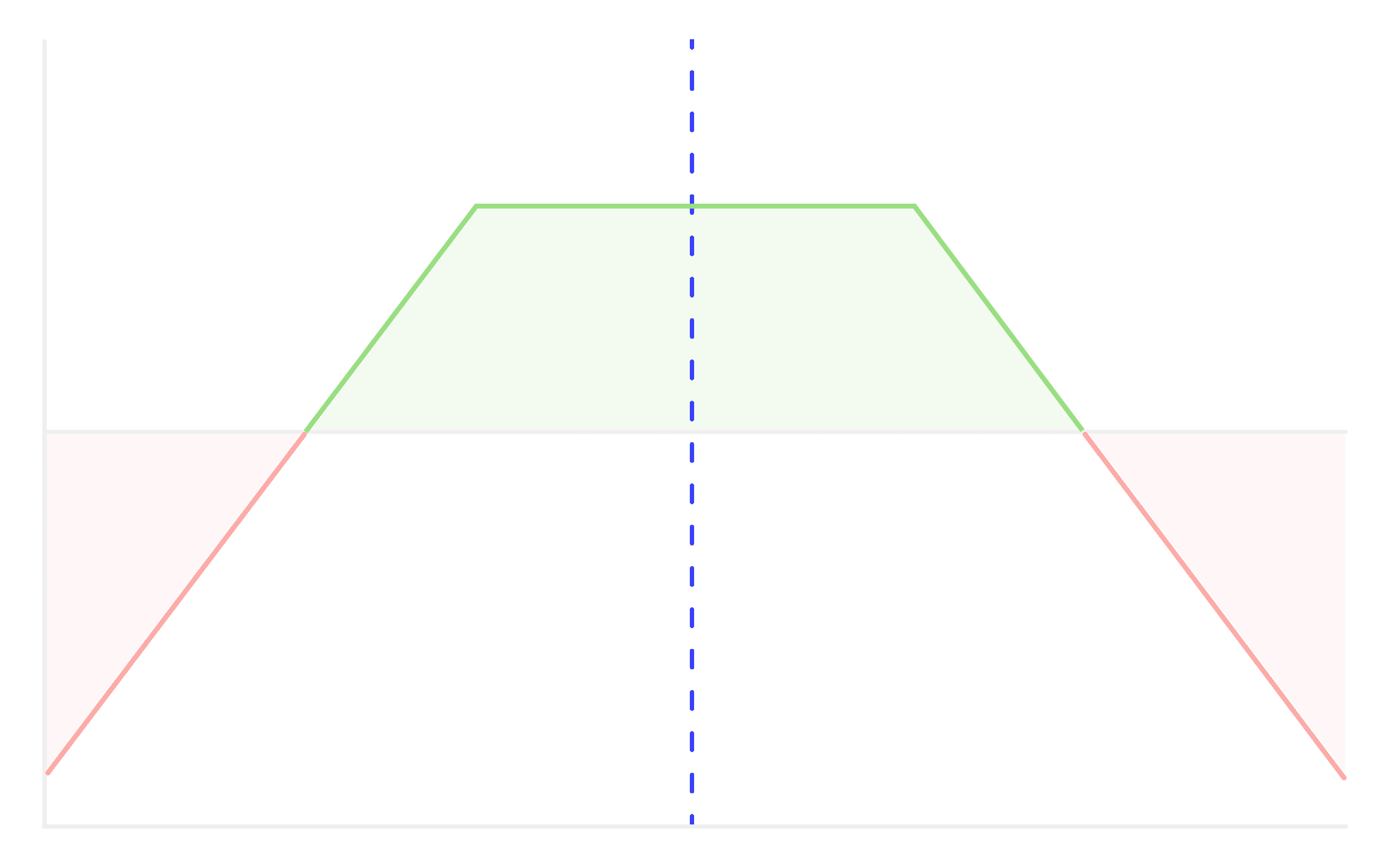

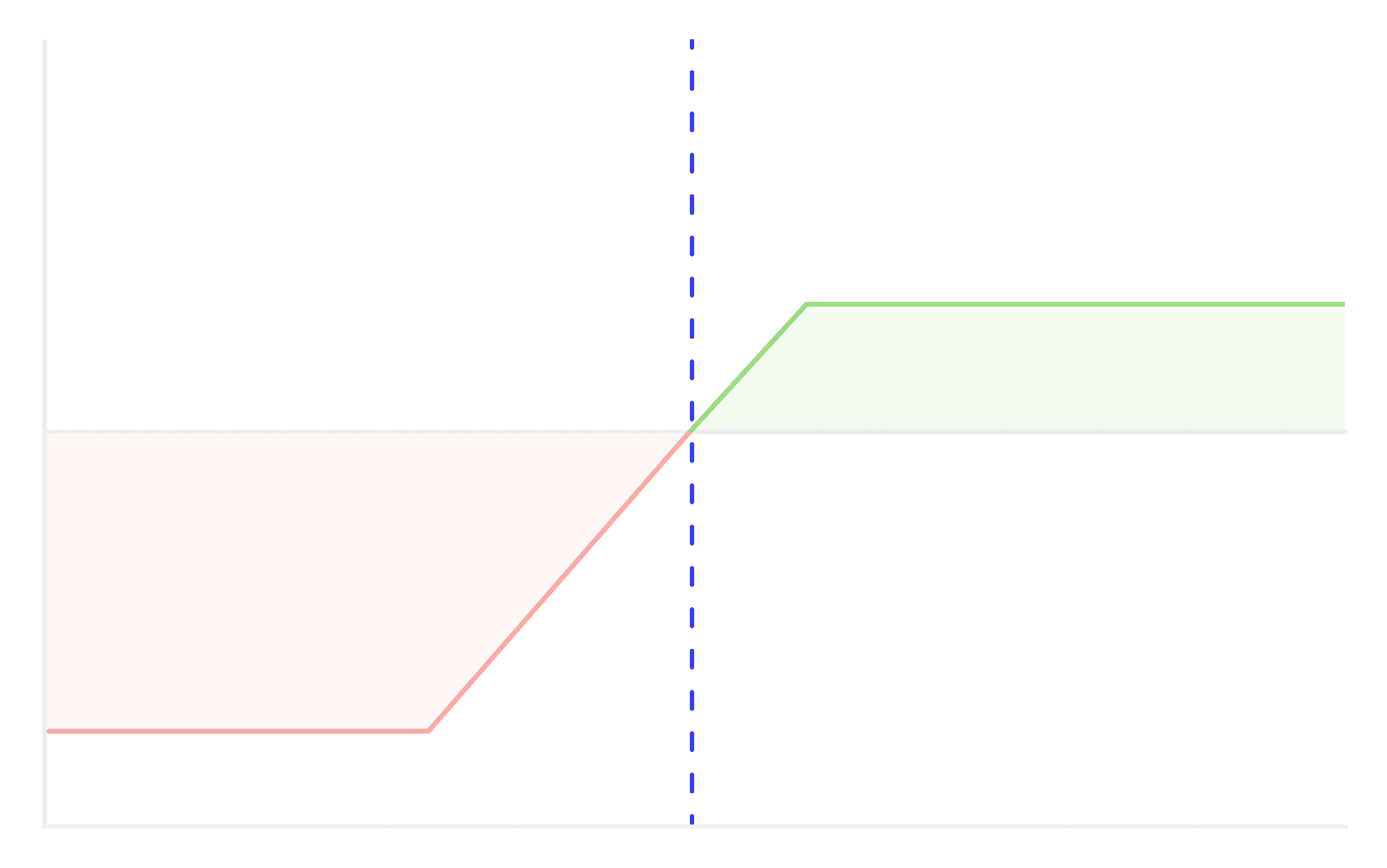

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

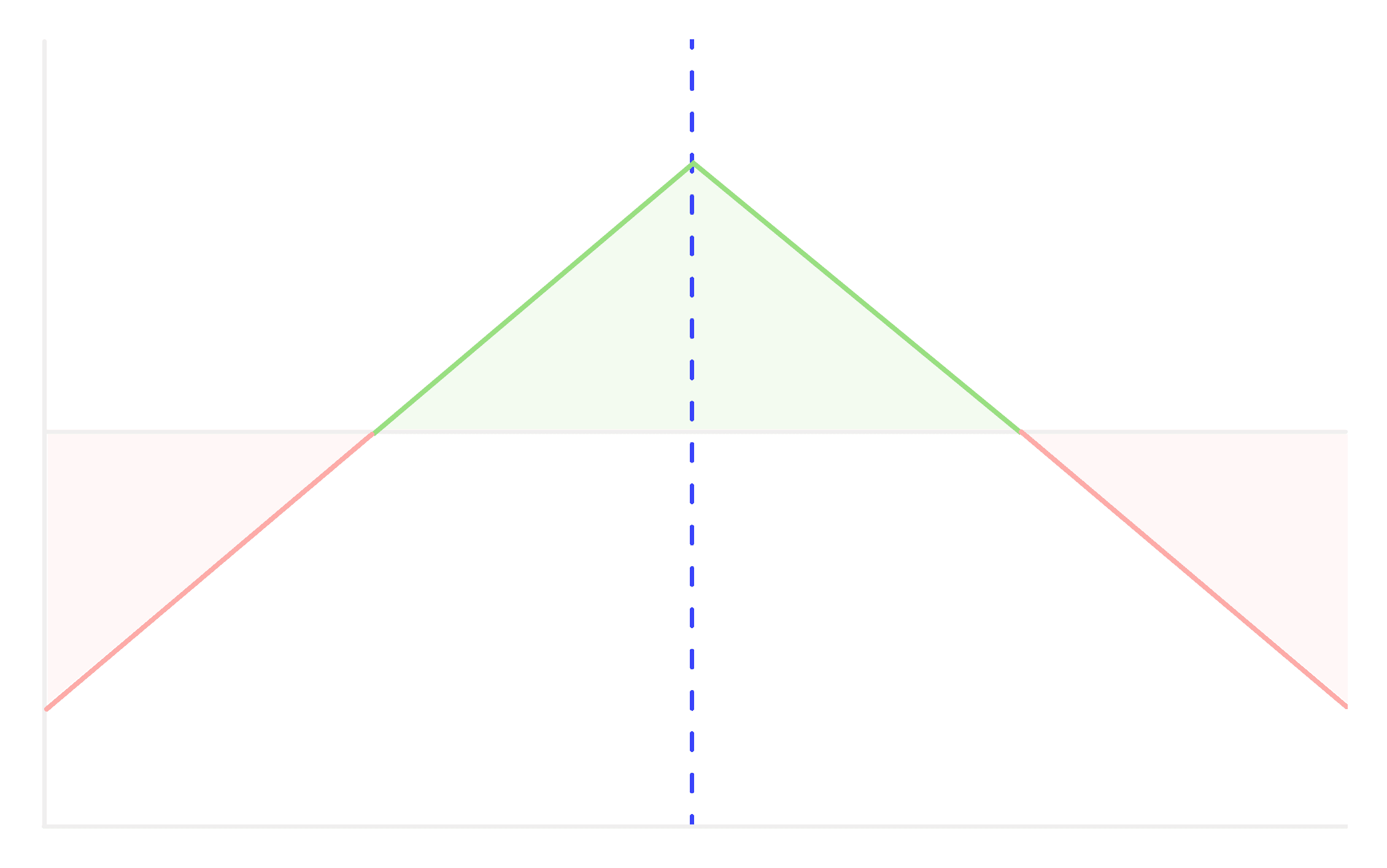

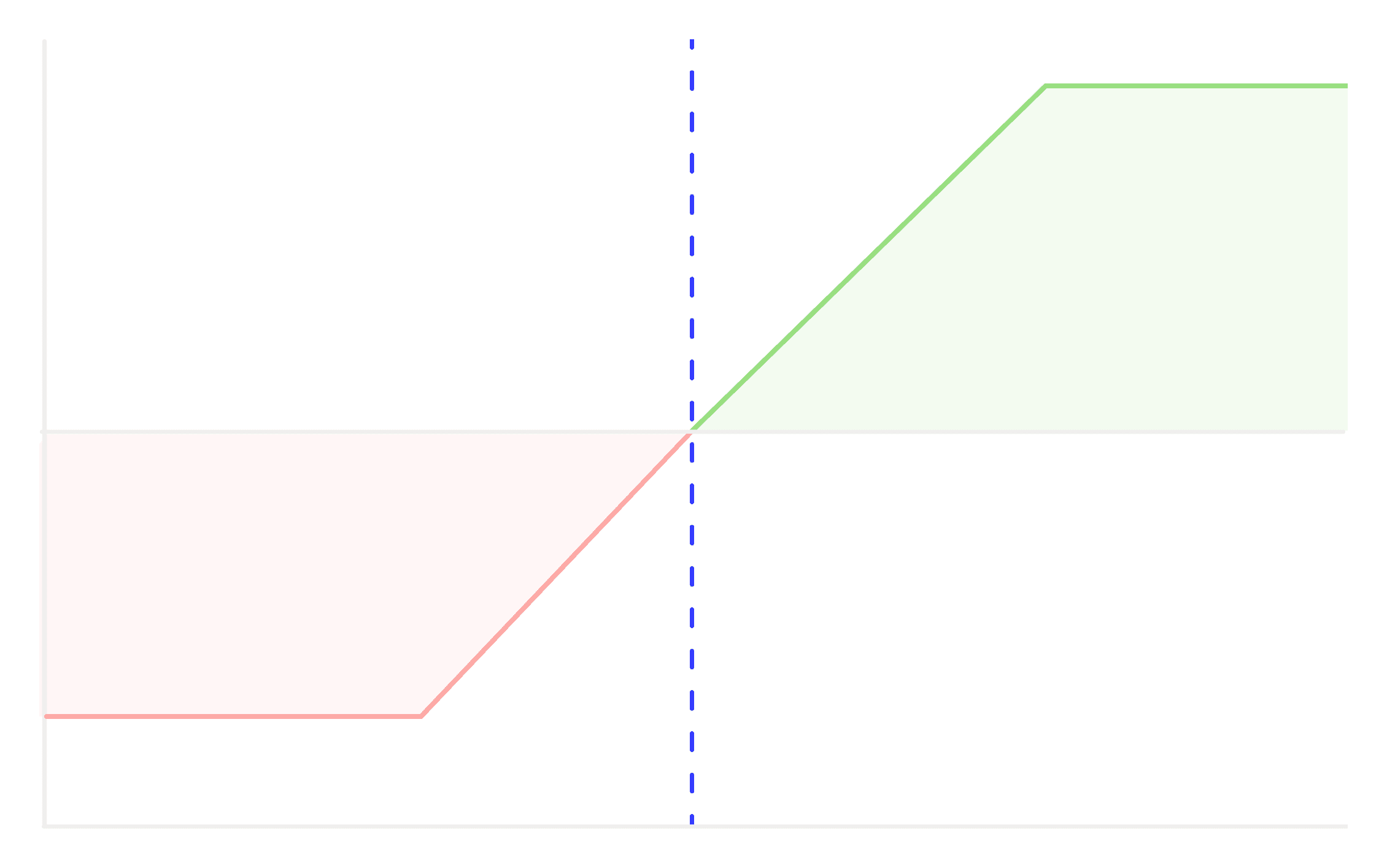

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

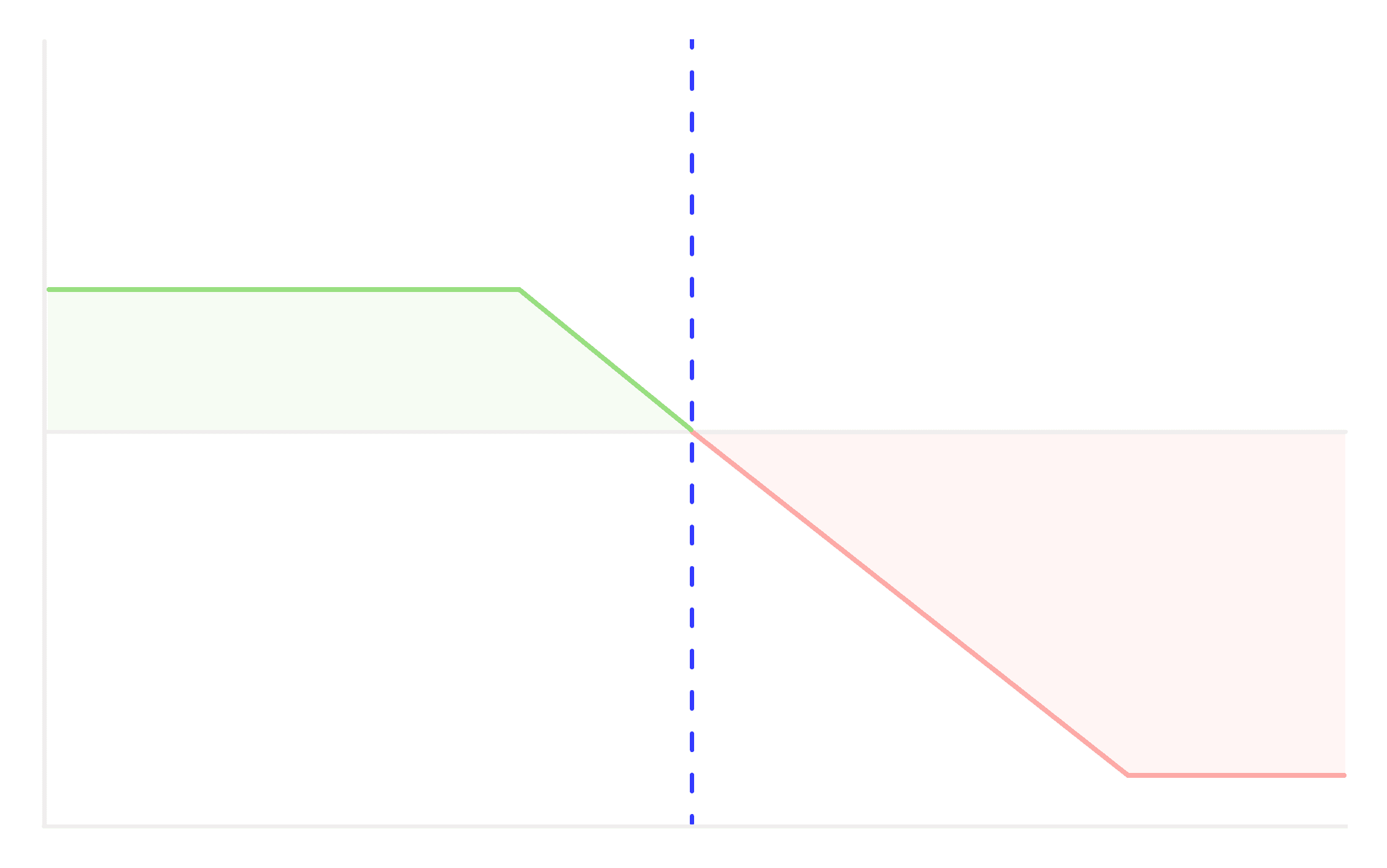

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

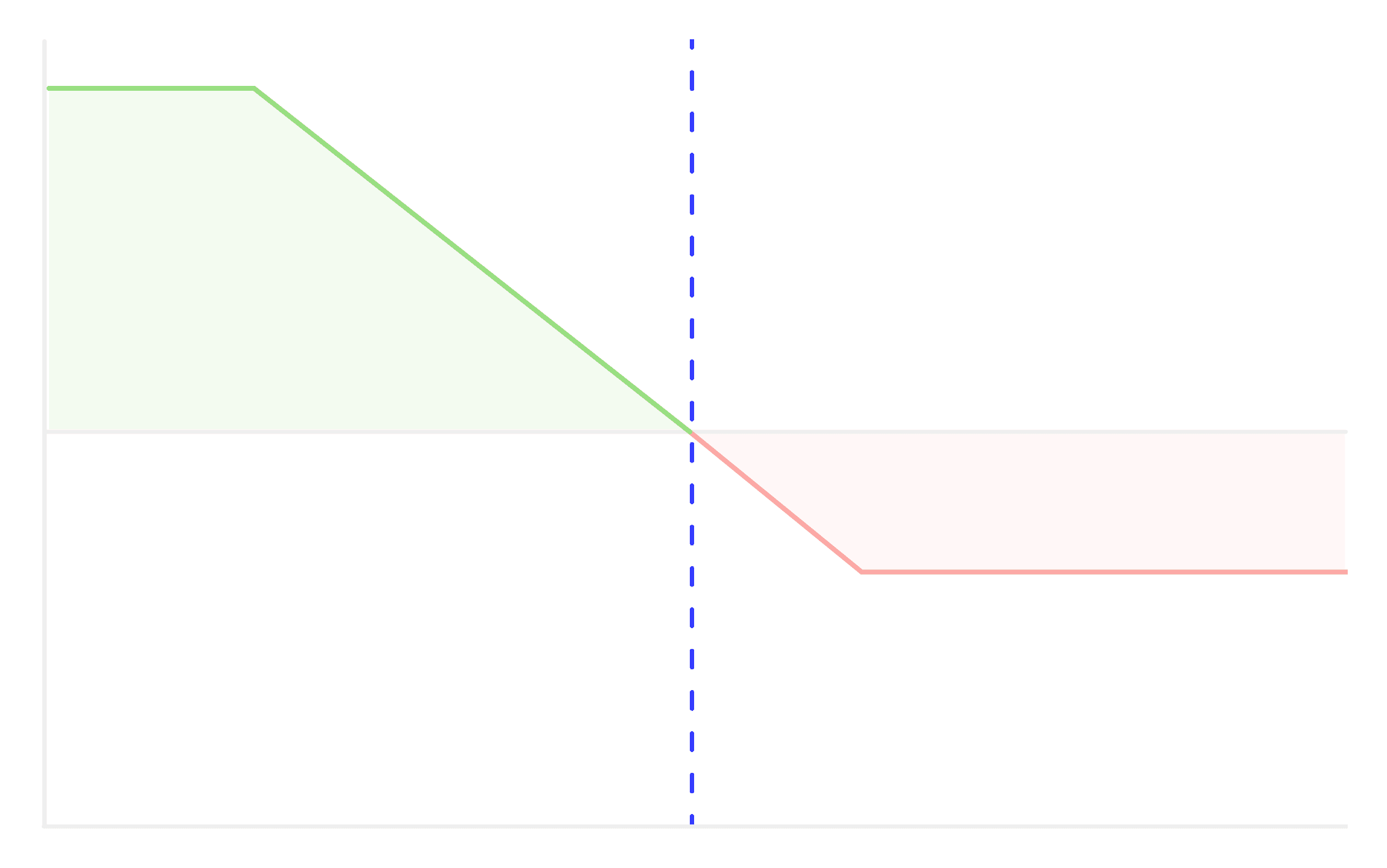

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

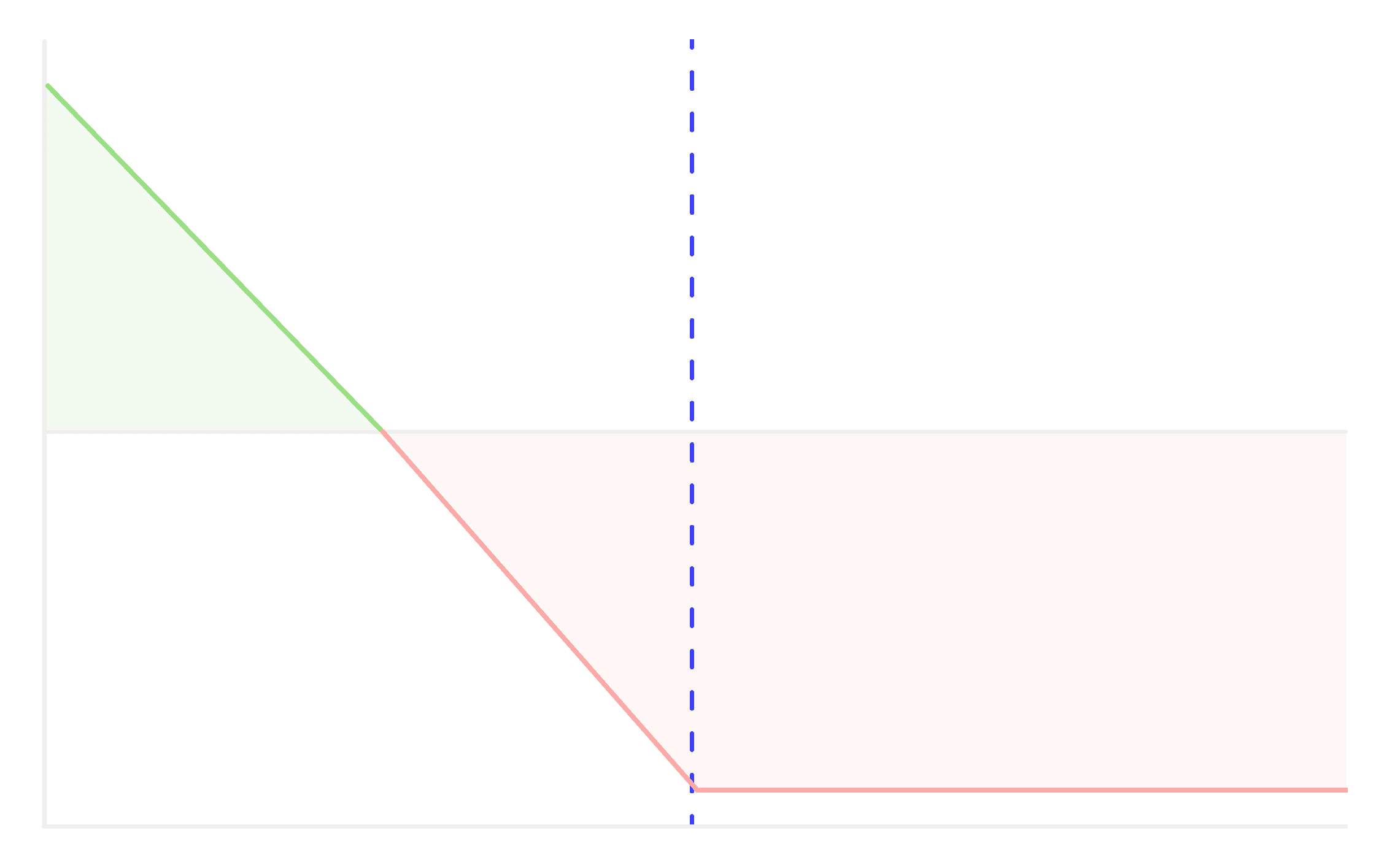

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions